Wal-Mart made headlines last week by endorsing proposals in Washington that mandate employer-provided health insurance. Fox New’s Elizabeth MacDonald does a good job analyzing the retail giant’s motives in her blog post and identifies competitive advantages that Wal-Mart would enjoy if this coverage were legally required. In essence, because Wal-Mart already covers many employees and has the pricing power of an enormous company, new universal mandates are more crippling to its competitors. MacDonald also argues that, by stepping forward now, Wal-Mart ensures a seat at the political table in shaping the legislation, ensuring that the law will be relatively beneficial to the company.

Wal-Mart’s action are a good example of the way that large companies, with their deep pockets and legions of lobbyists, can influence new regulations and legislation to their advantage at the expense of smaller competitors. The more regulation created, the more the potential for this type of mischief. This is not to pass judgment on the merits of the issue, but only to observe how large corporations can influence legislation in their favor better than smaller companies, and the more regulation, the greater the potential advantage.

It follows that a period of rising regulation can also be a period of relative advantage for large companies. I’ve written before that investors should expect large cap outperformanceover the next few years. The regulatory advantage is no doubt only a secondary or tertiary factor; I’ve tried to test relative large cap performance versus rising regulatory burdens (using proxies like the growth in pages of the Federal Register) and get inconclusive results as there are more important factors. Nonetheless, logic and anecdotal support this view, and the Wal-Mart/healthcare episode is but one more example.

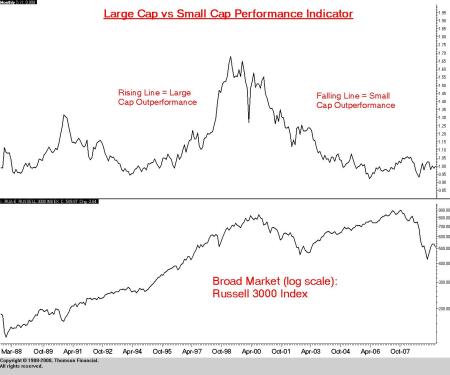

Certainly, large caps are putting in an unusually strong relative performance for this point in the investment cycle. Below is the chart, illustrating the long term trends — a rising line in the upper panel indicates large cap outperformance. Clearly the pronounced trend of small-cap outperformance since the end of the technology bubble broke in 2006. Since that time, there has been no pronounced broad capitalization advantage.

It is interesting to note that small caps typically have strong outperformance as cash is being put back into the market after a downturn. Cash flooding the market simply moves the price of smaller, less liquid companies more than that of larger ones. This year, the historical pattern has not held true. Reuters reported recently that cash levels are back to levels not seen since 2007 , and yet small caps performed essentially in line with large caps. This suggests that there is underlying relative weakness in the small cap segment. Although low interest rates may continue to drive cash levels lower, investors seeking yield are going to be biased towards bonds anyway. Clearly the good news for small cap in terms of investment cash flows into equities is now largely in the past. Superior liquidity, lower perceived risk, higher dividend yields, better ability to exploit emerging market demand, more access to credit, and yes, greater influence in shaping regulation, all point to the possibility of a long-term trend favoring large-cap stocks.

Disclosure: neither the author nor his clients have direct ownership of Wal-Mart stock. Clients of the author’s firm may own Wal-Mart through discretionary accounts managed by third-parties.

Tags: healthcare, large cap, Walmart

Leave a comment